AI Agent - Banking

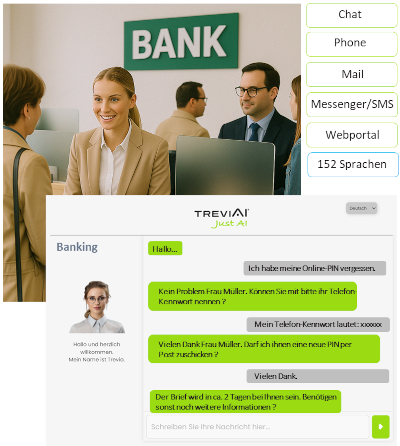

TREVIA© AI Agent - Banking

TREVIA brings digital intelligence to the financial world. As an AI-powered assistant, TREVIA automates banking processes, supports customers with service inquiries, and provides accurate information on products, conditions, or transactions – GDPR-compliant, secure, and in real time.

Trusted Communication Meets Smart Automation

Whether it's account information, loan advisory, branch search, or identity verification – TREVIA offers reliable assistance across all channels. At the same time, it reduces internal workloads, relieves staff, and ensures a first-class digital banking experience.

Rely on modern, secure, and automated customer communication – with TREVIA, your digital banking assistant.

Features and Technical Highlights

✔ Automated Customer Service

TREVIA answers standard questions about account balances, transfers, credit cards, IBANs, branch hours, or TAN procedures – multilingual and available 24/7.

✔ Advisory Support for Banking Products

From mortgage financing to retirement planning: TREVIA explains conditions, simulates scenarios, and connects to human advisors when needed.

✔ Multichannel Capability & Accessibility

Communication via phone, chat, app, or web – with accessible design, simple language, and live translation into 150+ languages.

✔ Seamless Integration with Core Banking Systems

With interfaces to systems like Avaloq, Temenos, Finacle, or in-house solutions, secure data access is ensured at all times.

✔ Compliance & Security Standards

TREVIA meets financial sector requirements – including GDPR, MaRisk, and BaFin-compliant operating models (On-Prem or Private Cloud).

Your Benefits at a Glance

✔ Lower Service Costs

TREVIA handles up to 80% of requests automatically – freeing advisors to focus on complex issues.

✔ Faster Customer Service

Whether at night, on weekends, or abroad – TREVIA is always available and provides instant answers.

✔ Increased Customer Satisfaction

Smooth processes, fast responses, and personalized service strengthen trust in your banking brand.

✔ Secure Handling of Sensitive Data

All data is encrypted, processed GDPR-compliantly, and subject to strict audit standards.

✔ Sales Support & Cross-Selling

TREVIA detects customer interests, suggests suitable products, and assists in initial consultations.

✔ Quick Integration & Custom Configuration

Thanks to modular architecture and proven interfaces, TREVIA is ready in just a few days – tailored to your branch or digital banking model.

Use Cases and Scenarios

✔ Account & Transaction Info

Customers can check balances, review recent transactions, or prepare transfers – directly via TREVIA.

✔ Loan Advisory & Product Comparison

TREVIA answers loan-related questions, shows available options, and simulates durations or interest models.

✔ Security Procedures & Verification

Report lost cards, initiate 2FA processes, or perform identity verification – TREVIA handles it reliably.

✔ Appointment Scheduling & Branch Routing

Book appointments, find branches, or manage queues digitally – TREVIA organizes it all in advance.

✔ Multilingual Premium Support

TREVIA assists customers in their native language – for queries about account types, portfolio management, or digital services.

Improvements

Ideal for All Industries

IT

Intelligent IT support for all inquiries – from 1st level incident reports to 2nd and 3rd level tickets, up to full IT automation.

More infoeCommerce

Interactive shopping experiences for your online stores – personal, consultative, sales-boosting & easily integrable into any web presence.

More infoSmart City

Digital assistants for cities, municipalities, and citizen services – fast, citizen-oriented, efficient & supporting 152 languages.

More infoCRM

Smarter customer service and intelligent CRM management for a new level of customer interaction.

More infoBanking

Secure AI agents for accounts, loans, and consultations – reliable and compliant with all regulatory requirements.

More infoHealthcare

Medical AI agents for health insurers, medical practices, and pharmacies – competent, relieving, and always up to date.

More info